Construction Economics

About VERTEX’s Construction Economics

Corporate expansion through bull and bear markets alike requires a culture of growth and awareness of current market conditions. VERTEX’s senior leadership perform economic analysis and economic assessment for the architecture, engineering and construction (AEC) industry because growth of AEC companies, or lack thereof, is often dictated by overall market conditions.

VERTEX has averaged 20%-plus year-over-year growth for nearly 25 years. VERTEX’s co-founder and Chairman of the Board, William J. McConnell PE, JD, along with construction expert, Tim Bonfatti often keep track of current and historic data trends, look at the unique anomalies and where the state of the industry is currently. They will also outline where indicators show we are headed.

- Spending

- Employment

- Inflation

- Industry

- Other

Total Construction Spending

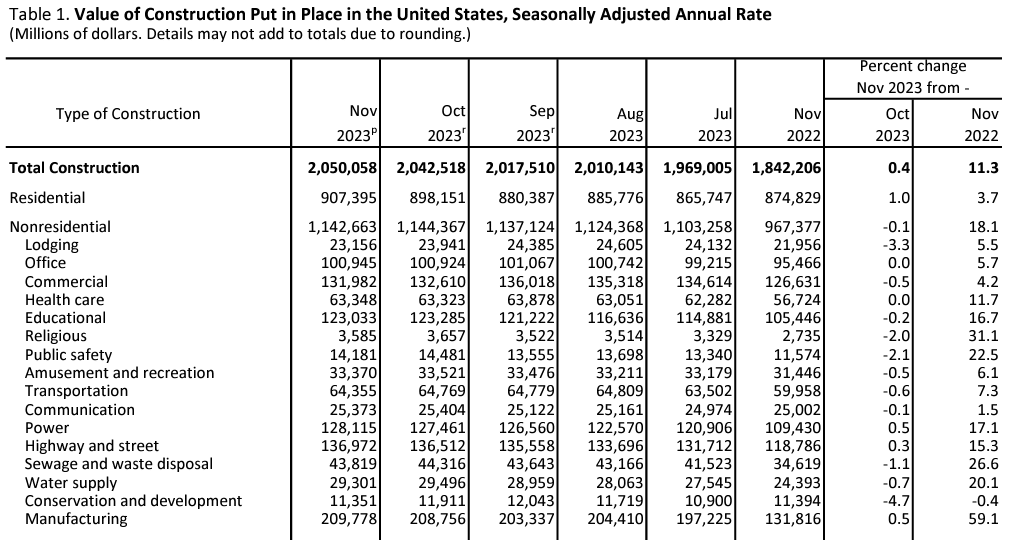

VERTEX monitors the total construction spending to spot any changes in trends. Since a majority of construction spending is on professional labor, this becomes a good indicator on the health and growth of the industry.

Construction Spending Percent Change (Year over Year)

VERTEX analyzes each sector of construction spending as well as their yearly changes. The following chart of percent change provides an easier view of which sectors are having the highest growth of contraction.

Construction Employment

VERTEX looks closely at the total employees employed at the construction industry as an indicator. Historically the construction industry experiences large fluctuations of employment during recessions and expansions.

Unemployment Rate

VERTEX looks closely at the Bureau of Labor’s Statistics’ Unemployment Rate (U-3) to analyze whether the United States is experiencing a recession and the severity of it.

Labor Force Participation

While unemployment rate (U-3) focuses on active seekers of jobs, the labor participation rate gives a broader view of how many people have joined or left the workforce during the expansions and recessions.

Consumer Price Index: All Items in US, Annual Percent Change

Personal Consumption Expenditures, Annual Percent Change

Producer Price Index, Construction Materials

Federal Funds Effective Rate

The interest rate is one of the primary tools the Federal Reserve uses to help steer the economy. It goes without saying that interest ultimately impacts the ability to finance both private and public construction projects.

The Yield Curve (10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity)

The US Treasury issues bonds at different maturities for both short-term and longer-term needs of investment institutions. The yield of a bond depends on the purchase price, face value, and the rate of return. When there is a “flight to safety” situation, institutional money typically goes to purchasing the 10-year treasury notes, increasing the price and lowering the yield.

When the Yield curve between 10-year and 2-year goes below zero it is significant indicator of a recession. VERTEX closely monitors the movement of this yield curve due to how much recessions impact the construction industry.

30-Year Fixed Mortgage Average in United States

Changes in the 30-year mortgage rate impacts the demand for residential housing, a major sector of construction.

Crude Oil Prices: West Texas Intermediate (WTI) – Annual Dollars per Barrel Change

The price of oil is a major indicator to measure the change of prices for transporting construction materials, as well as the cost of some construction materials.

Real GDP Quarterly Change

CBOE Volatility Index: VIX

Corporate Profits After Tax with Inventory Valuation Adjustment (IVA) and Capital Consumption Adjustment (CCAdj)

US Federal Debt as Percent of GDP

UoM: Consumer Sentiment Index

Value of Construction Put in Place in the US, seasonally adjusted annual rate

Previous Updates:

Updates and Insights:

- 2025 Q1 Construction Industry Update – 5.5.25

- Construction Costs & Inflation Review – 6.6.24

- 2024 Q1 Construction Industry Update – 5.15.24

Economic Experts

Chairman of the Board