What is Use Tax?

A use tax is like sales tax, but instead of being levied when goods are purchased, it – as the name implies – is applied on the use of those goods. These taxes are imposed by states in the U.S. when goods are purchased from out-of-state sellers for use within the state. The tax is meant to level the playing field for in-state businesses and to ensure that out-of-state purchases are subject to the same taxes as in-state purchases. In this post, we explore use taxes and the implications of these levies for the construction industry.

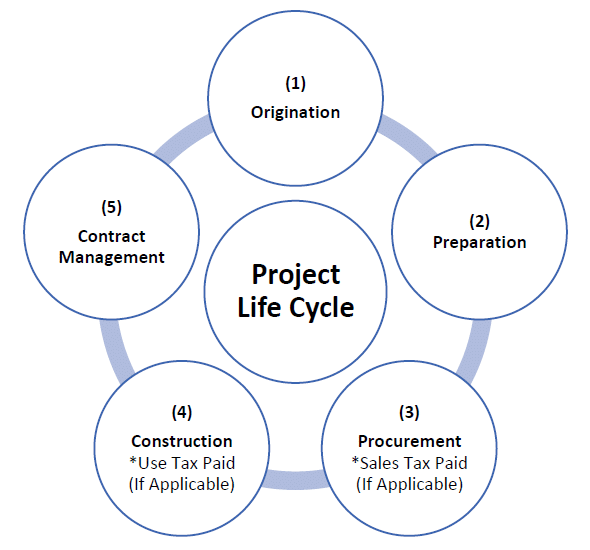

Figure 1: Project Life Cycle w/ Tax Application

How is Use Tax Calculated?

The calculation of use tax is like the calculation of sales tax. The tax is calculated as a percentage of the purchase price of the goods. The specific percentage varies by state, with some states having a higher rate than others. In most states, the use tax rate is the same as the sales tax rate.

Purchase Price of Goods ∗ Tax Rate (as a percentage) = Use Tax Owed

Equation 1: Use Tax Owed Calculation

Construction Companies & Taxes: A Complex Landscape that Requires Careful Navigation

The construction industry is heavily reliant on materials and equipment purchased from out-of-state suppliers. Not all states require sales tax to be charged at the time of purchase, but instead require that a use tax be applied only after a product has been used or consumed. Generally, the responsibility of the construction contractor to pay the tax on materials is dependent upon the type of contract and the state in which the materials were purchased. The following list of states and contract types are those in which purchases made by the construction contractor are exempt from sales tax but instead are subject to use tax.

- Lump-Sum Contracts: Arizona, Hawaii, Mississippi, Nebraska

,and New Mexico - Itemized Contracts: Arizona, Colorado, District of Columbia, Hawaii, Indiana, Mississippi, Nebraska, New Mexico, and Texas

There are five states where sales tax is not charged:

- States with No Sales Tax: Alaska, Delaware, Montana, New Hampshire, and Oregon

Because regulations regarding sales and use taxes vary from state to state, it is important for construction companies to understand and properly manage sales and use tax obligations.

Not only does proper management of these obligations help ensure compliance with state laws, but it can also help reduce costs for construction companies. By properly tracking and reporting use tax, companies can avoid costly fines and penalties for non-compliance.

Who Pays the Use Tax?

The responsibility for paying use tax falls on the consumer or end-user of the goods. In the case of construction, this would typically be the construction company. However, in some cases, the responsibility may fall on the owner of the construction project. The owner of a construction project would be responsible for paying the use tax in two scenarios:

- The first scenario is one in which the contract between the construction company and the owner explicitly states that the owner is responsible for paying the use tax.

- The second scenario is only applicable in states where the owner of a construction project might be considered the end-user of certain types of equipment or materials, even if provided by the contractor.

Avoiding Fines and Penalties: Track, Report and Turn to an Expert

Construction companies can ensure compliance with use tax laws by properly tracking and reporting all out-of-state purchases. This can be done by implementing a system for tracking and reporting use tax obligations and by working with a tax professional who can help ensure compliance with all applicable laws and regulations.

It is also important for construction companies to stay informed about changes to use tax laws in their state. Many states constantly update and change use tax laws, and it is crucial for companies to stay up to date on these changes to ensure compliance.

Use Tax is one component of many that makes up a complete construction estimate. If you need expert consulting, estimating, or related construction expert services, reach out to VERTEX’s qualified experts, or submit an inquiry.

Author: Curtis Grupe