In addition to project-specific costs, contractors rely on project revenue to support, or “absorb”, their home office general and administrative (G&A) costs. If project duration increases but the associated revenue does not, the same amount of revenue must be stretched even further. As a result, when a contractor submits a delay claim for an event caused by conditions out of their control, they seek to recover the damages related to home office overhead (HOOH) costs, as well as the extended general condition or field overhead costs.

What is Home Office Overhead (HOOH)?

HOOH costs typically include salaries and benefits for office personnel, insurance costs, office utilities, sales and marketing costs, legal expenses, and other indirect costs, which cannot be allocated to a specific project but are incurred as part of the company’s general operations. To address the financial impact on these costs in the case of project delays, the courts have developed several formulas (there are at least nine) to quantify unabsorbed HOOH. The Eichleay Formula is the exclusive remedy for calculating HOOH on contracts with the federal government, and thus, is the most common formula used in construction delay claims.

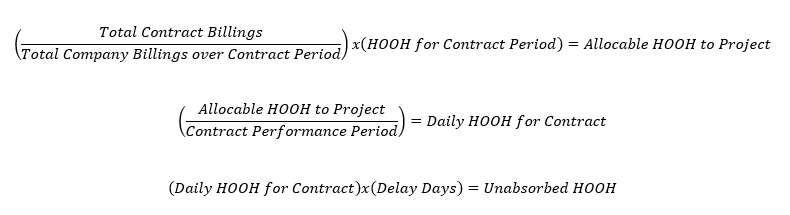

The Eichleay Formula calculates HOOH costs as a function of a firm’s revenue. The HOOH costs allocable to the project are divided over the project duration (inclusive of the delay period) to arrive at a daily HOOH rate. That daily rate is then multiplied by the compensable delay duration to arrive at the extended HOOH costs attributable to the impact.

Using the Eichleay Formula as an Estimating Tool

While the Eichleay Formula is common, it has several limitations due to the fact that the Eichleay Formula is an estimating tool — not a proper accounting formula. These include:

- An assumption that revenue and overhead are directly proportional, which may not be the case.

- An assumption that overhead costs are fixed and as a result does not adequately account for fluctuations over time. In other words, it assumes a firm’s HOOH is the same no matter when the delay occurs.

- The inclusion of non-G&A or improper expenses in the calculation. The claimed home office overhead costs should only include indirect expenses. Certain contracts may stipulate what items are allowed in indirect cost calculations. For example, the federal government limits the types of costs that can be considered a HOOH expense. [1]

The Eichleay Formula is especially tough to apply to a situation where a firm is very small and has only one or two projects. If a firm only has one active project, the Eichleay Formula will find the HOOH to be 100% allocable to that one project, even if that firm’s home office expends resources in pursuit of other work or on efforts not attributable to the project.

Limitations of the Eichleay Formula

In addition to these accounting-related issues, the Eichleay Formula presents procedural issues that limit its use. One major limitation of the Eichleay Formula is that it can only be at the very end of the project. That means that if a proactive owner tries to resolve a delay claim while the project is ongoing, the Eichleay Formula cannot be applied.

When Can the Eichleay Formula Be Used to Recover HOOH Costs?

All of these challenges pale in significance to the hurdles that a claimant must overcome in order to use the Eichleay Formula to recover HOOH costs in a construction delay claim. To do so, three requirements must be met:

- A delay must solely be government-caused and no concurrent or third-party delay exists – the standard requirement for demonstrating entitlement to any compensable time extension.

- The delay was of uncertain duration and the contractor was required to be ready to resume work almost immediately after receiving notice from the government (commonly known as the “standby requirement”).

- The contractor must be able to demonstrate that the government’s delay prevented or made it impractical for the contractor to undertake additional work which may have absorbed the home office overhead expenses. This last requirement is typically tied to the “standby requirement.” If the contractor is expected to be ready to return to work at a moment’s notice, it is not practical for the workforce to mobilize to a new site.

The cautionary takeaway is to know when and how best to apply the Eichleay Formula in a claim to recover extended home office overhead expenses.

If you would like to learn more about VERTEX’s Construction Claims Consulting services or to speak with a Construction Expert, call 888.298.5162 or submit an inquiry.

Reference

- [1] Federal Acquisition Regulation, 48 C.F.R. § 31.205-1 to 31.205-24 (2014)