I’m a numbers guy. Analyzing data helps me make sense of the world around me. It always has. After more than 30 years in this business, I’m still drawn to the opportunity to examine data in order to glean insights into what the future holds for our business as well as our industry as a whole.

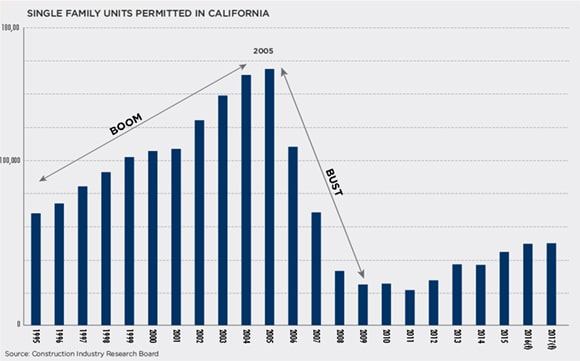

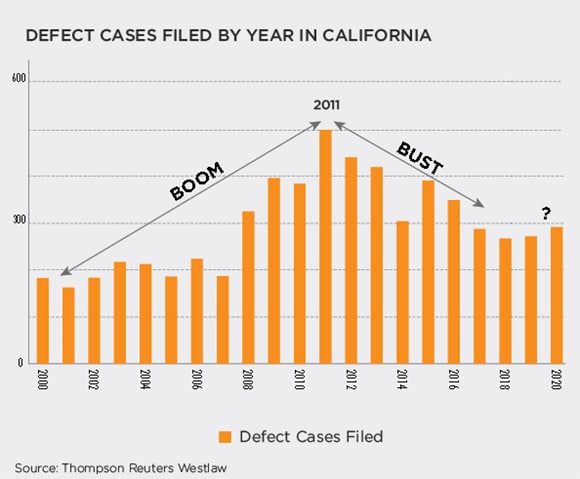

Back in 2011, we discovered a very interesting correlation between the number of residential building permits issued in California and the construction defects lawsuits filed six years later. Based on that information, we predicted a significant decrease in defects litigation was just ahead, as we moved from litigating the boom to litigating the bust.

About 50% of the construction labor force had lost their jobs in the Great Recession, but the defects world was still very active litigating the boom. In the run-up to the housing bubble, it was not too surprising that the number of construction defect cases filed in California grew steadily from 2000 to 2010, a little more than doubling in that 10-year period. The residential permit volume and construction defect volume trends had been almost an exact match, with a five-to-six-year lag.

The accompanying graphs are updated from that analysis and were used in our presentation to the West Coast Casualty Conference, the largest conference for the defects industry, in 2012, where we projected a possible dramatic decrease in defects litigation cases was coming soon.

So, what happened? Did the prediction of an upcoming bust in defect litigation prove to be true?

Defect case filings peaked in California in 2011, six years after the 2005 peak in residential construction. Then, from 2011 to 2014, defect case filings dropped by approximately 40%. Residential construction bottomed out in 2011 and has been climbing out slowly since. We have seen a boom in apartment construction, but residential for-sale housing has remained at recession levels.

To find fewer residential units less than 10 years old, and therefore eligible to litigate under the statute in California, we must go back over 32 years, to before 1984.

Everything is tied to demographics. Millennials have not wanted to get into the housing market, and Baby Boomers have been looking to downsize. We are starting to see an increase in residential for-sale housing starts and, as millennials start to have kids, we should see a much more robust housing market returning to normal levels.

So, what lies ahead for defects litigation?

We have probably found the bottom of the defects curve. As we predicted back in 2011, we have seen an increase in large, complex cases involving schools, apartment buildings, and commercial buildings, which is likely to continue. As we build out of the recession, we can expect that the five- to six-year litigation lag following construction will also continue. Apartments have traditionally had a lower frequency of litigation than for-sale housing, and we expect that will remain the case. So, we won’t see litigation at the same levels that we saw after the last boom until five to six years after for-sale housing returns to the 2005 levels – which may be a long time away. The good news for builders and insurance carriers is that the massive subdivision cases are probably not coming back anytime soon.

Author: Ted Bumgardner

This article was originally published by Xpera Group which is now part of The Vertex Companies, LLC.