The construction industry booms in a growth economy with low inflation. This phenomenon is often short lived save for the past five years where the US has realized a perfect storm of low unemployment and low inflation. As a consequence of this rare economic backdrop, the construction industry expanded by 48% between 2012 and 2016 ($791 billion in Jan-2012 to $1,172 billion in Oct-2016), which represents year over year growth of nearly 11%. Recent indicators, however, suggest that inflationary pressures are edging back and, as a result, interest rates are on the rise, which will slow the fevered pace of real estate development. Inflationary pressures is further evidenced by the minor pullback in the value of the US dollar over this past month. Accordingly, the bull market for private construction will sadly come to an end in 2017 or early 2018, at which time the industry will pivot into a reasonably favorable bear market. VERTEX anticipates that any reduction in private construction, which represents nearly three-quarters of the overall construction industry, will be mildly offset by an increase in public construction spending, which has been flat for the past decade ($290M in 2007 and $286M in 2016).

Inflation

Historically, a sluggish US economy is signified by annual inflation of under 2%. Since the Great Recession of 2008, the US has experienced very little inflation: 2009 (-0.4%); 2010 (1.6%); 2011 (3.2%); 2012 (2.1%); 2013 (1.5%); 2014 (1.6%); 2015 (0.1%); 2016 (2.1%). The CPI jumped in 2011 to 3.2%, in large part due to the spike in oil, when the price per barrel of West Texas Intermediate crude oil spiked to just over $121. Since then, the price plummeted to just below $30/barrel in early 2016 before rebounding by 83% to $53/barrel as of January of 2017. This recent spike in energy prices causing a slight increase in the all items CPI, and it will likely continue into 2017. I expect the annual CPI to reach nearly 3% in 2017, which will signify the highest jump in inflation in six years.

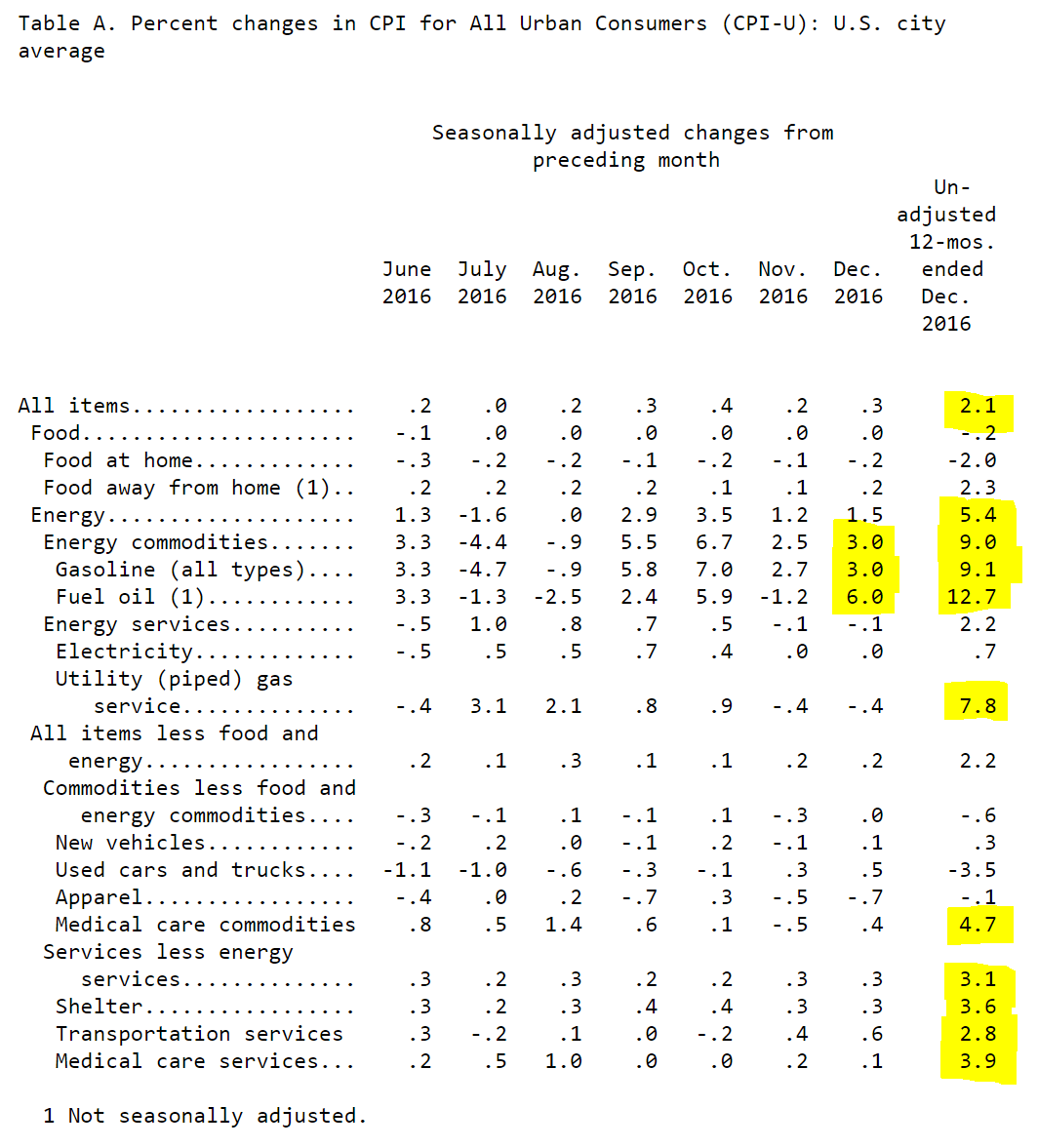

This recent spike in energy pricing is causing a slight increase in the all items CPI, and it will likely continue into 2017. I expect the annual CPI to reach nearly 3% in 2017 based on this trend, which will be the highest rate since 2011. Below is the Bureau of Labor Statistics’ January 18, 2017 release of final 2016 data.

Percent Changes for All Urban Consumers – US City Average

Interest Rates

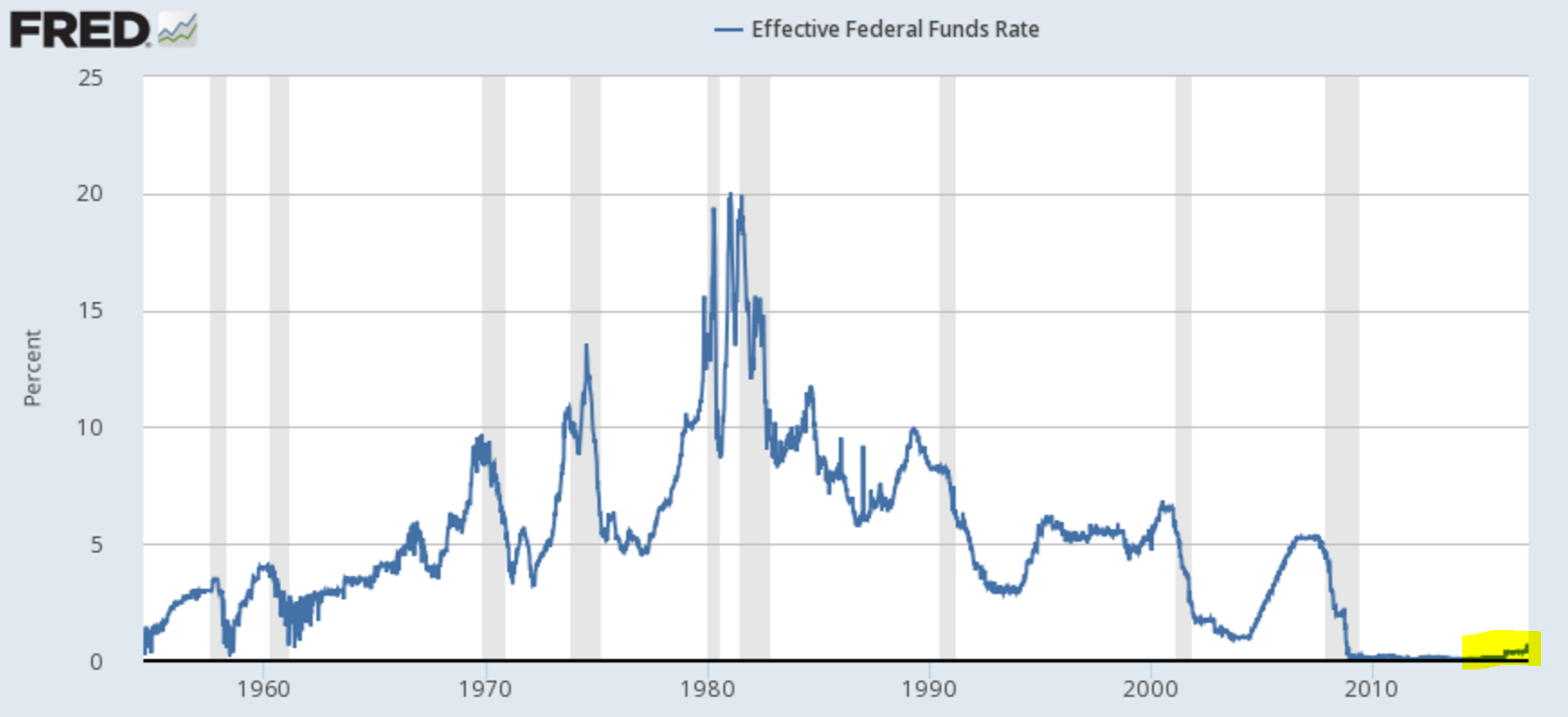

In December of 2015, after ten years of rates cuts and little movement, the FOMC made a quarter point increase to the Federal Funds Rate—from 0.00-0.25 to 0.25-0.50. One year later, in December of 2016, the FOMC increased the Federal Funds Rate by another quarter point, to 0.50-0.75. Economists are calling for further rate increases in 2017 to potentially cool down inflationary pressures.

US Dollar

A rise in the US dollar typically reflects a strong economy, stable inflation, and rising productivity. A strong dollar benefits US consumers and US companies importing raw materials and intermediate goods because foreign goods and services are cheaper. In other words, real purchasing power increases for this group. Because the US is such a net importer of foreign goods and services, the strong dollar is welcomed. On the other hand, the strong dollar can negatively affect US industrial firms that derive some revenue from non-US dollar currencies. The following is a chart of the US Dollar Index over the past five years. The dollar made two large jumps over the past five years—the first in the latter part of 2014 and the second in the early part of 2016. If inflation and interest rates rise in 2017, which I expect will happen, the dollar index will drop accordingly.